Powered By:

Today’s Summary

Monday, June 5, 2023

Indices: Nasdaq +0.07% | Dow -0.59% | S&P 500 -0.20% | Russell 2000 -1.32%

Sectors: 4 of the 11 sectors closed higher. Utilities led, gaining +0.48%. Industrials lagged, falling -0.69%.

Commodities: Crude Oil futures gained +0.57% to $72.15 per barrel. Gold futures rose +0.24% to $1,974 per oz.

Currencies: The US Dollar Index was flat (-0.05%) and continues to trade at $104.00.

Crypto: Bitcoin dropped -5.11% to $25,739. Ethereum dropped -4.23% to $1,811.

Interest Rates: The US 10-year Treasury yield fell to 3.685%.

Here are the best charts, articles, and ideas being shared on the web today!

Chart of the Day

Tough day in crypto. If bitcoin gets below $25,000 there's not a lot of support until the $20,000 level. pic.twitter.com/ieCJzzJ7kw

— Brian Lund (@bclund) June 5, 2023

Today’s Chart of the Day was shared by Brian Lund (@bclund). It's a daily chart of Bitcoin year-to-date. Bitcoin broke the neckline of a bearish head & shoulders pattern today and it's starting to test the August/February highs, around $25k. As Brian point's out, if it breaks $25k, it would open the door for roughly ~20% further downside, as there's no apparent support until around $20k. Keep an eye on how Bitcoin reacts as it tests this key level.

Quote of the Day

“Charts don’t give answers, they raise questions. Inferences are drawn when enough questions point in the same direction.”

- Mark Ungewitter

Trendlines > Headlines

https://youtu.be/LI0FltCDCPE

In this week’s episode, David Lundgren of MOTR Capital Management joined us to break down the markets. We discussed trend following, breadth, AI stocks, and more!

Top Links

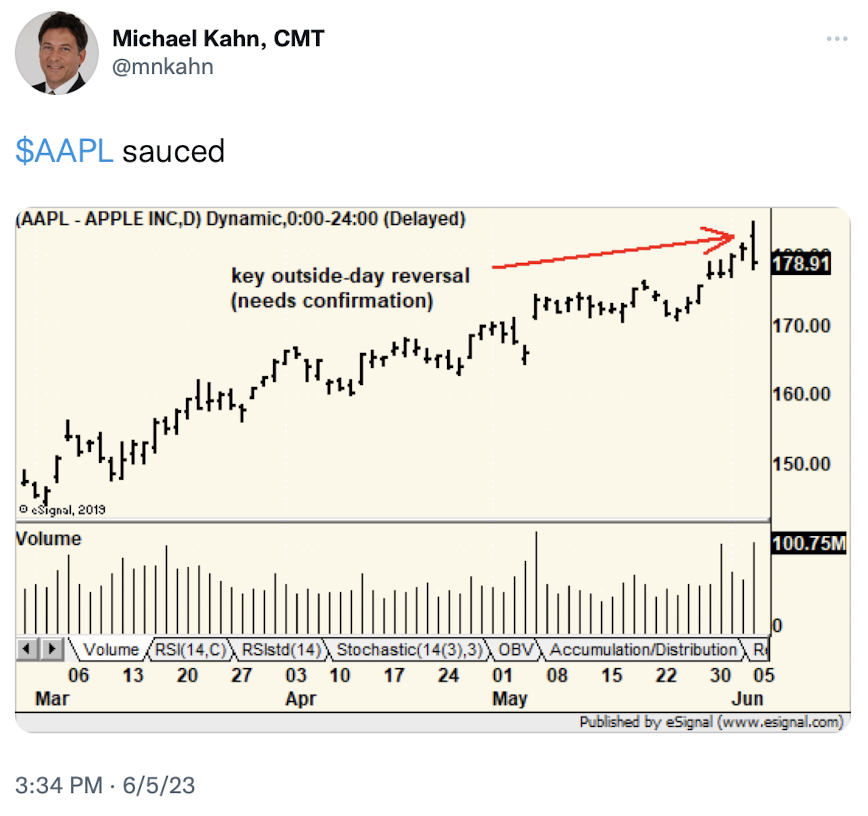

The Apple Effect: Unraveling AAPL's Breakout Patterns - Day Traders Playbook

Yuriy Matso examines the sharp intraday reversal in $AAPL.

The Bull Case for Energy is Clear - StockCharts.com

David Keller looks at the bull case for the Energy sector.

Tiny Bucket Hats - The Weekly Trend

In this podcast, David Zarling and Ian McMillan discuss some of the most important technical developments going on right now.

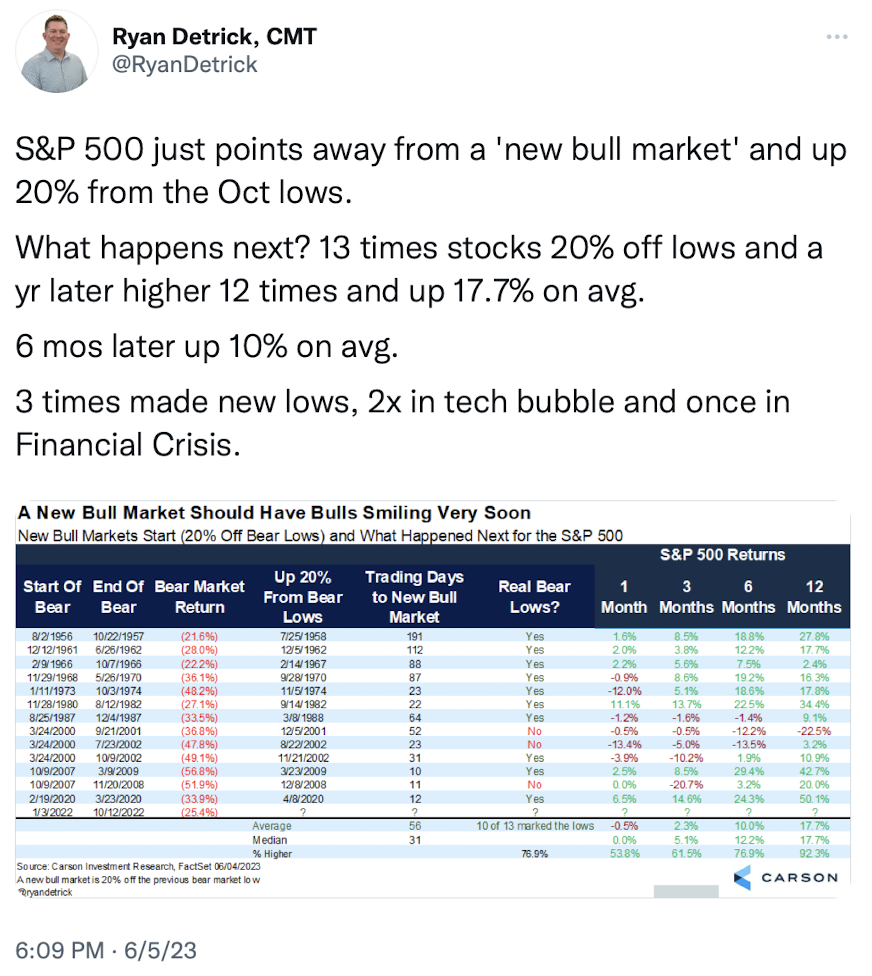

The Stock Market's Fear Gauge Just Hit its Lowest Level in 3 Years as a New Bull Market Kicks Off - Business Insider

Several technicians share their thoughts on the $VIX as it sank to multi-year lows on Friday.