5 Things to Know About Martin Zweig

Whoever said: “I’ve never met a rich technician” had clearly never met Marty Zweig.

Zweig is considered one of the greatest technicians of all time, and he was undoubtedly wealthy considering he owned the most expensive apartment in Manhattan (at the time).

He wrote a popular newsletter called The Zweig Forecast and authored several books, but his big claim to fame was predicting the 1987 crash.

His work was influenced by the trend-following sub-culture of that era and he made some notable contributions to Technical Analysis.

Here are some things you should know about him.

1.) He Predicted the 1987 crash

On Friday, October 16th, 1987, Zweig made an appearance on the popular TV program, Wall Street Week with Louis Rukeyser. He spent his air time outlining why he thought the market was about to crash. He emphasized that he wasn't anticipating a prolonged bear market, but rather, a sharp crash followed by a violent rally. And that's exactly what happened...

The following Monday, October 19th, the stock market had its worst day ever known as Black Monday. The Dow Jones Industrial Average collapsed more than 22% in a single day. Zweig's interview begins at about 6½ minutes into the clip below. It's probably the most timely market call in the history of financial media.

&feature=youtu.be

2.) The Put/Call Ratio

While working on his Ph.D. dissertation at Michigan State University, Zweig created the Put-Call Ratio - a now-popular short-term sentiment indicator that compares the volume of put options to call options. The ratio is used to gauge the level of fear & greed in the market. Like most sentiment indicators, it's used as a contrarian indicator when the ratio is at an extreme. The options market was still in its infancy when Zweig introduced the Put-Call Ratio, but it's become a popular timing tool.

3.) Breadth Thrust Indicator

Zweig understood that things like sentiment, momentum, and breadth drove the market in the short term. In addition to creating the Put-Call Ratio, Zweig also developed the Breadth Thrust Indicator, a breadth/momentum indicator used to identify major shifts in the primary trend. It's calculated by dividing the number of advancing issues by the number of total issues and creating a 10-day exponential average of that figure. Between the years of 1945 and 2000, this indicator flashed 14 buy signals with an average gain of 24% in the 11 months following the signals.

4.) "Don't Fight the Tape"

This was one of Zweig's cardinal rules. In his book, Winning on Wall Street, he famously said this about fighting trends:

"Big money is made in the stock market by being on the right side of major moves, I don't believe in swimming against the tide. -- The idea is to get in harmony with the market. It’s suicidal to fight trends. They have a higher probability of continuing than not."

5.) "Don't Fight the Fed”

Zweig's second cardinal rule couldn't be more relevant right now. It echoes famous market aphorisms like; "the market can stay irrational longer than you can remain solvent." Sure interest rates have a huge influence on the Stock Market and the Economy, but a lot of traders get burned trying to figure out how and when monetary policy will affect the stock market. We all know the perma-bears out there who have been calling for a recession due to a Fed-induced asset bubble. Without naming names, they've been wrong for years trying to fight the Fed.

Zweig used Macro and Fundamental Analysis as a jumping-off point to identify what to buy. From there, he would employ Technical Analysis to time his entries and exits. Like most profitable traders, he understood the importance of risk management, writing;

"According to my rulebook, the only consistent way to make money in the market is to cut losses and run with profits. You can be right on individual stocks as little as 30% of the time and still do well if you can get out when the getting is good."

Unfortunately, Zweig passed away in 2013 but his wisdom continues to be relevant today.

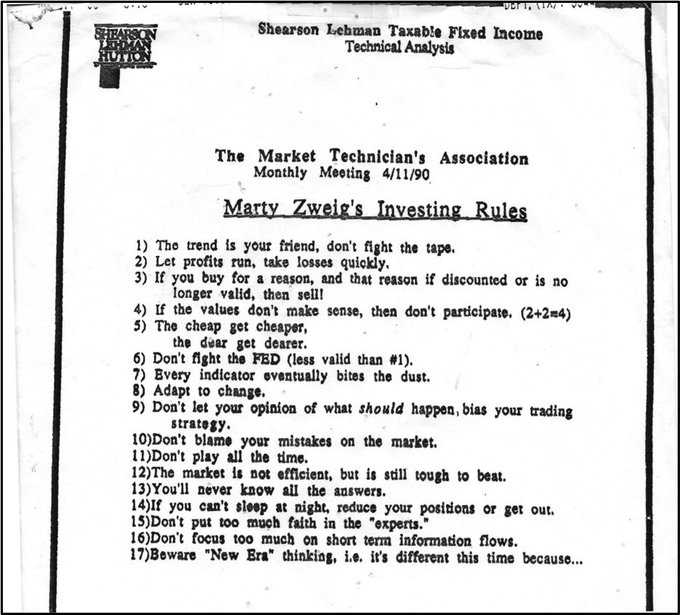

You can find his 12 famous investing rules in the photo below.