Daily Chart Report 📈 Thursday, June 1, 2023

Powered By:

Today’s Summary

Thursday, June 1, 2023

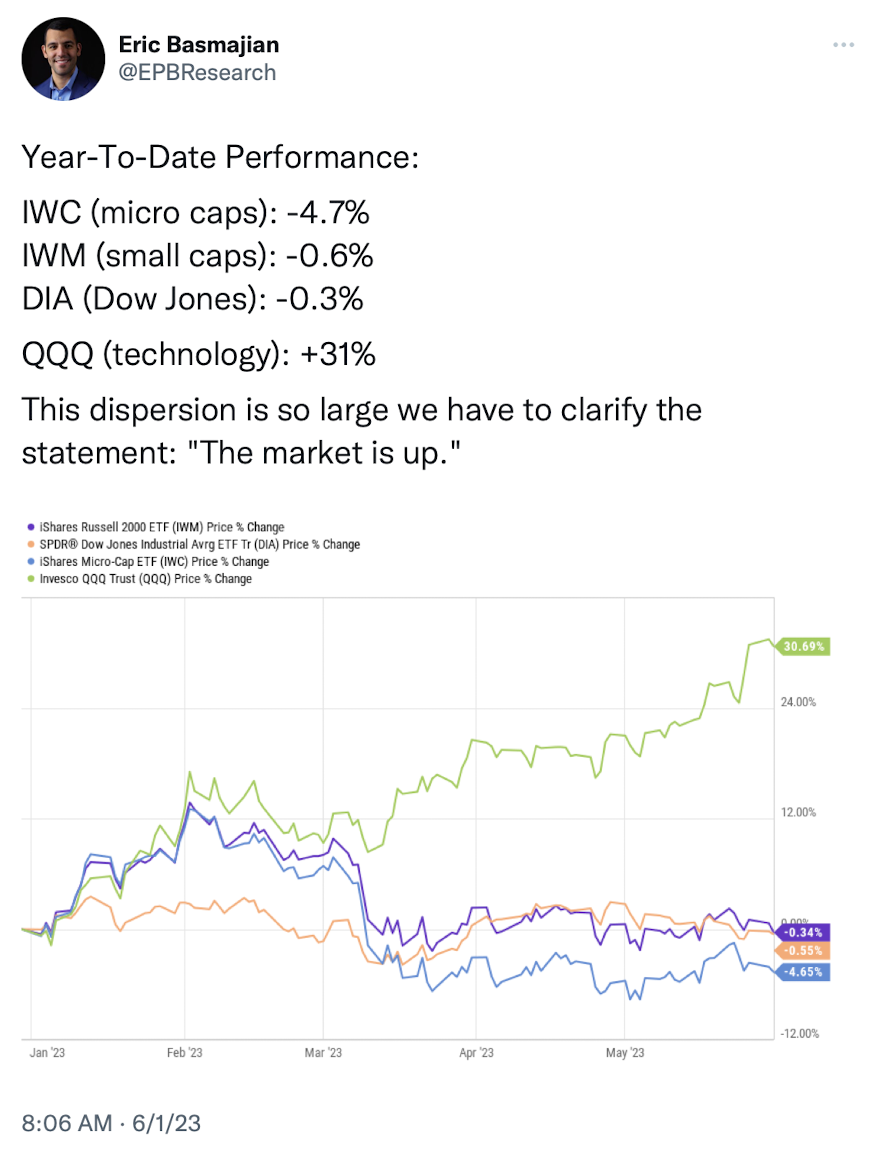

Indices: Nasdaq +1.31% | Russell 2000 +1.05% | S&P 500 +0.98% | Dow +0.47%

Sectors: 9 of the 11 sectors closed higher. Communications led, rising +1.35%. Utilities lagged, dropping -0.74%.

Commodities: Crude Oil futures gained +2.95% to $70.10 per barrel. Gold futures rose +0.68% to $1,996 per oz.

Currencies: The US Dollar Index dropped -0.64% to $103.56.

Crypto: Bitcoin fell -1.20% to $26,893. Ethereum inched lower by -0.31% to $1,868.

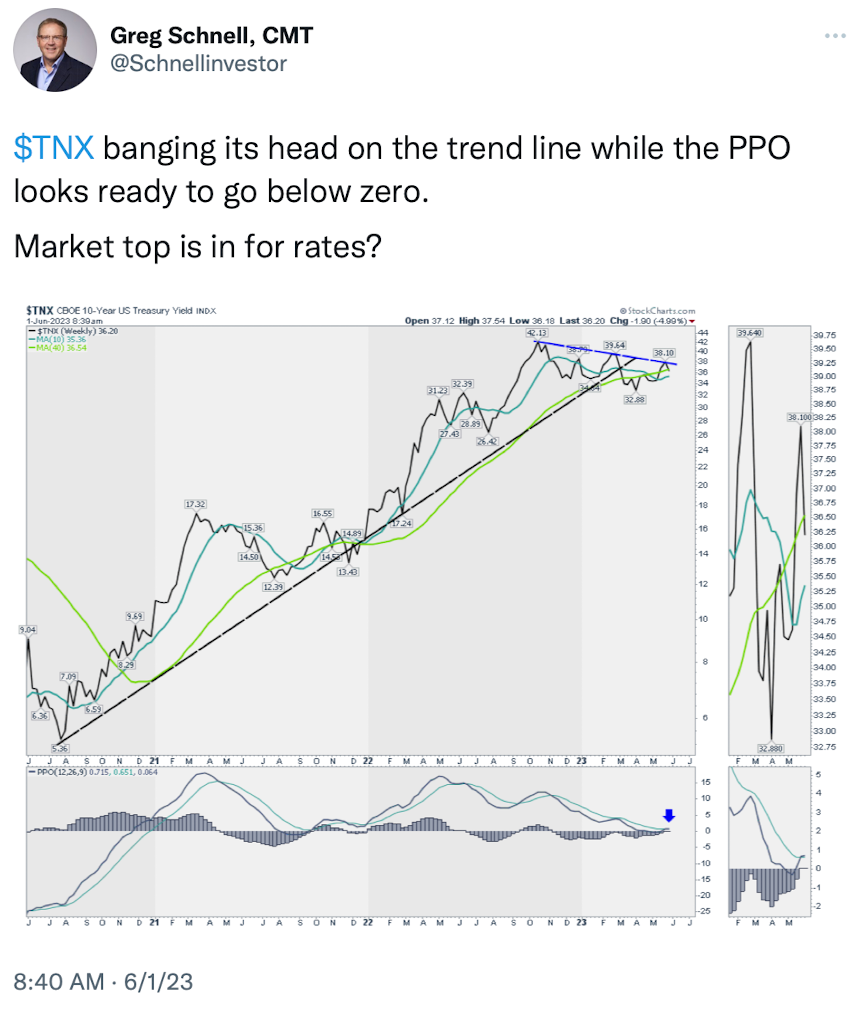

Interest Rates: The US 10-year Treasury yield fell for the fifth consecutive day to 3.599%.

Here are the best charts, articles, and ideas being shared on the web today!

Chart of the Day

Today’s Chart of the Day was shared in a note by Jeff Hirsch of The Stock Trader's Almanac. The chart show June's intra-month seasonal pattern for the Dow (red), S&P 500 (green), Nasdaq (blue), Russell 1000 (purple), and Russell 2000 (black). June hasn't been very bullish over the past 21-years (solid lines) with four of the five major indices showing negative average returns. However, Jeff points out that June's seasonal pattern significantly improves during pre-election years like 2023 (dashed lines). In pre-election years, all five indices have historically ended the month higher. The Nasdaq has been the strongest, gaining more than 2% on average. The Dow has been the weakest, but it still gained more than 1% on average. For more on June seasonality, check out the full note here.

Quote of the Day

"We're in the regret business.

If you buy and it goes down, you regret buying.

If you buy and it goes up, you regret not buying more."

– David Lundgren

Top Links

May and YTD 2023 Asset Class Performance - Bespoke

Bespoke breaks down the performance of various asset classes in May and YTD.

The June Swoon? - Carson Group

Ryan Detrick highlights some noteworthy stats about June seasonality.

Interest Rates: Don't Fight the Trend - All Star Charts

Ian Culley looks at the 10-year yield and Cattle prices.

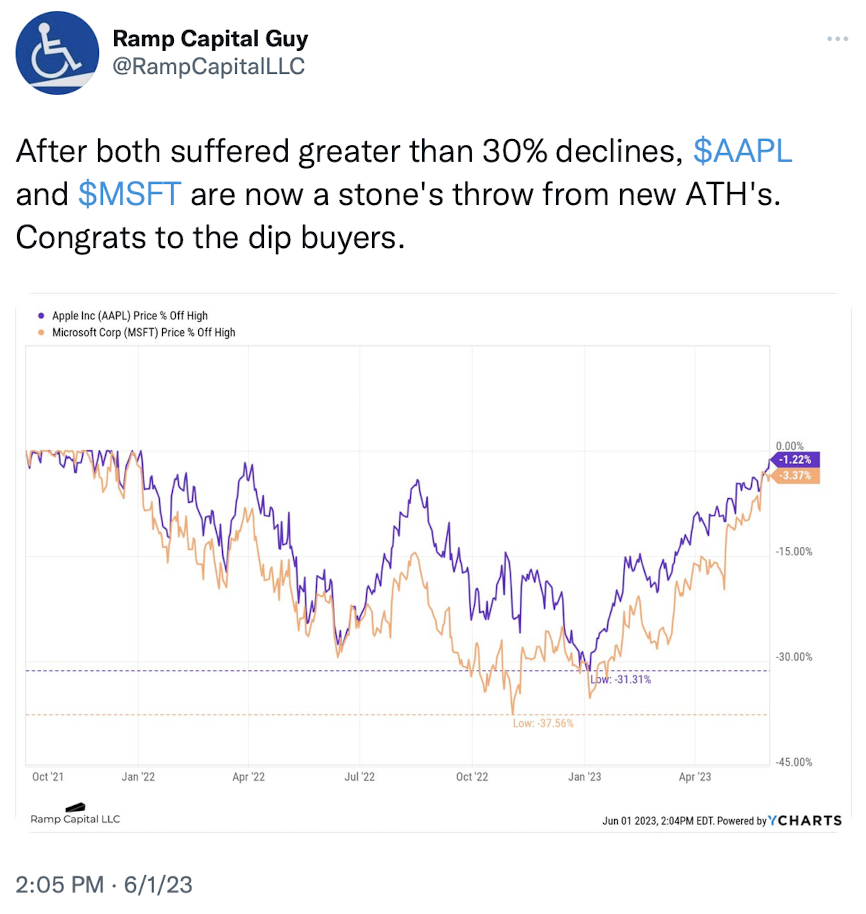

Tech-related ETFs Post Huge 2023 Gains with Boost From AI Hype, But Some Big Ones Still are Left with Outflows - Morningstar

In this article, several analysts highlight the key takeaways from ETF flows in May.

Top Tweets

You’re all caught up now. Thanks for reading!