Daily Chart Report 📈 Friday, June 2, 2023

Powered By:

Today’s Summary

Friday, June 2, 2023

Indices: Russell 2000 +3.56% | Dow +2.12% | S&P 500 +1.45% | Nasdaq +0.73%

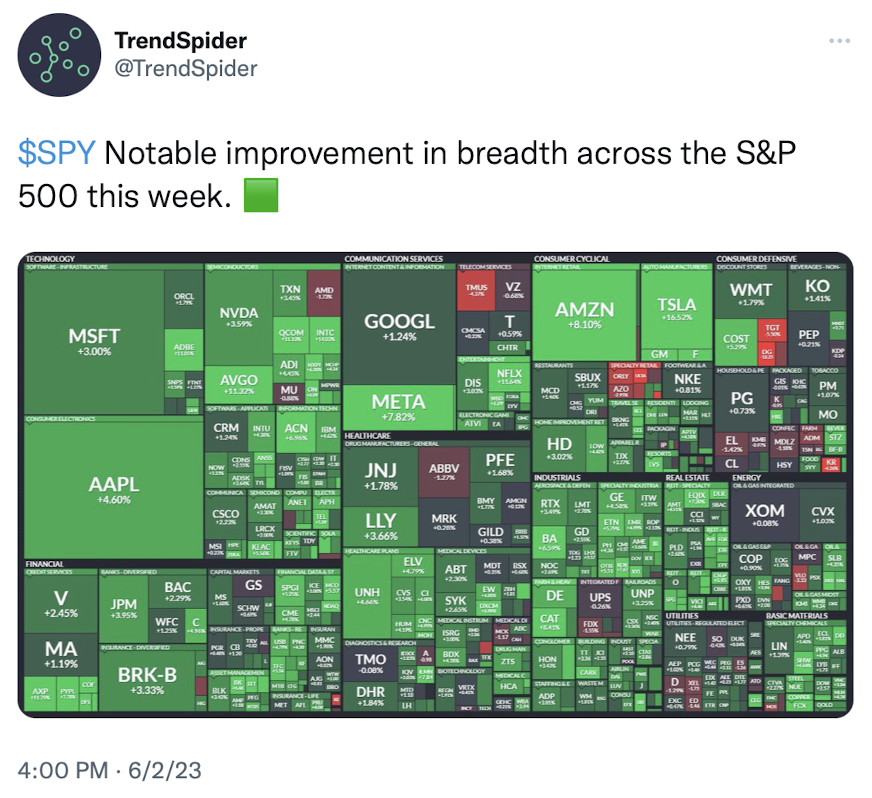

Sectors: All 11 sectors closed higher. Materials led, gaining +3.35%. Communications lagged, but still inched higher by +0.13%.

Commodities: Crude Oil futures gained +2.34% to $71.74 per barrel. Gold futures dropped -1.30% to $1,970 per oz.

Currencies: The US Dollar Index rose +0.46% to $104.04.

Crypto: Bitcoin rose +1.58% to $27,251. Ethereum gained +2.41% to $1,907.

Interest Rates: The US 10-year Treasury yield snapped a five day losing streak, rising to 3.696%.

Here are the best charts, articles, and ideas being shared on the web today!

Chart of the Day

$RSP

S&P500 equally weighted…

Taking your breath away to solve the breadth issue…

GAP on VOLUME out of the channel and clipping the 200days MAV

RSI never confirmed the lows of the channel. pic.twitter.com/fhm3OPWxOD— conradseric, CMT, CAIA, CEFA (@conradseric) June 2, 2023

Today’s Chart of the Day was shared by Eric Conrads (@conradseric). Breadth has been one of the biggest threats to the bull case recently. However, the equally weighted S&P 500 ETF, $RSP, made quite a stand today. Eric points out that $RSP smashed above its 200-day moving average on record high volume. It’s also constructive to see that RSI never reached oversold conditions (bottom pane). What will the bears complain about next if breadth starts to improve?

Quote of the Day

“Because in the end, you won’t remember the time you spent working in the office or mowing your lawn. Climb that goddamn mountain.”

– Jack Kerouac

Trendlines > Headlines

https://youtu.be/LI0FltCDCPE

In this week’s episode, David Lundgren of MOTR Capital Management joined us to break down the markets. We discussed trend following, breadth, AI stocks, and more!

Top Links

Stock Market Analysis June 2 2023 – Alphatrends

In this quick video, Brian Shannon recaps this week’s price action and highlights some key levels to watch in the near term.

June Technical Market Outlook – Grindstone Intelligence

Austin Harrison highlights some key charts to watch this month.

Renaissance’s Jeff deGraaf Weighs in on The Believability of the Market Rally – CNBC

Jeff deGraaf shares his thoughts on the current market environment.

Bad Breadth – eToro

Callie Cox examines the narrow leadership in the markets.

Uranium Stocks Approach a Key Breakout – All Star Charts

Ian Culley points out that Uranium stocks are attempting to break out.

Top Tweets

You’re all caught up now. Thanks for reading!