Daily Chart Report 📈 Wednesday, June 7 2023

Powered By:

Today’s Summary

Wednesday, June 7, 2023

Indices: Russell 2000 +1.78% | Dow +0.27% | S&P 500 -0.38% | Nasdaq -1.75%

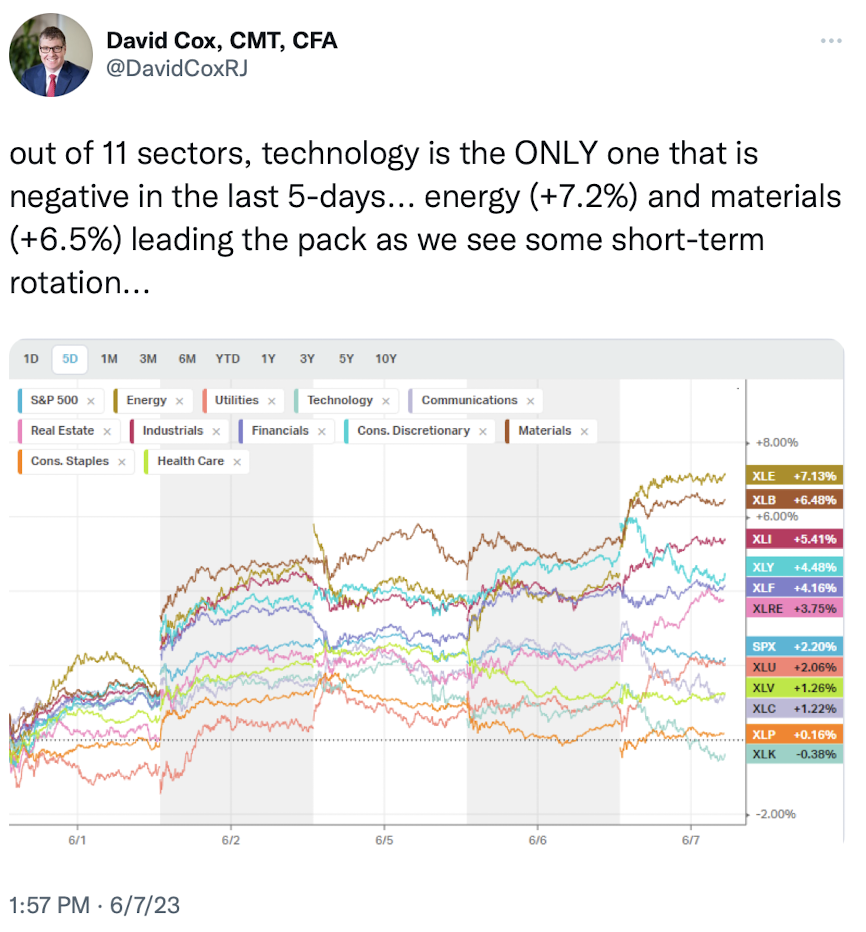

Sectors: 6 of the 11 sectors closed higher. Energy led, gaining +2.65%. Technology lagged, falling -1.49%.

Commodities: Crude Oil futures rose +1.10% to $72.53 per barrel. Gold futures dropped -1.17% to $1,958 per oz.

Currencies: The US Dollar Index was flat and remains at $104.11.

Crypto: Bitcoin dropped -3.42% to $26,305. Ethereum fell -2.85% to $1,831.

Interest Rates: The US 10-year Treasury yield moved higher to 3.799%.

Here are the best charts, articles, and ideas being shared on the web today!

Chart of the Day

Another raging upside day for mid and small caps. pic.twitter.com/aAJo3eJNdk

— Louis Spector (@EastCoastCharts) June 7, 2023

Today’s Chart of the Day was shared by Louis Spector (@EastCoastCharts). The chart shows Large Caps (S&P 500), Mid Caps, and Small Caps over the past two years. While the S&P 500 battles with its August highs, Small/Mid Caps have caught up in a big way. The week isn’t over yet, but Small Caps are on track for their best weekly performance vs. Large Caps in more than a year. All three indices are now above their 50-DMA (blue) and 200-DMA (red). The next upside objective for all three will be taking out their respective August/February highs. This rotation into Small/Mid Caps is extremely constructive for the broader market, as it alleviates concerns over weak breadth and narrow leadership.

Quote of the Day

“Rotation is the lifeblood of any bull market.”

– Ralph Acampora

Top Links

Charts are Showing a Discernable Shift – Ciovacco Capital Management

Chris Ciovacco highlights some of the technical improvements that have taken place recently.

Timing is Everything – Trading Adventures

Andy Moss gives a midweek update on the markets.

We Are in a New Bull Market: Ryan Detrick – Fox Business News

In this quick clip, Ryan Detrick explains why he’s ready to call it a new bull.

Historical Performance Amid Bad Breadth – Schaeffer’s Investment Research

Rocky White examines how the S&P 500 has historically performed when breadth has been weak.

The Chart Report is now better than ever…

Introducing The Chart Report: Private Access.

Private Access is everything you love about The Chart Report – plus MORE charts, trade ideas, and access to our exclusive scans and model portfolio updates.