Daily Chart Report 📈 Friday, June 9, 2023

Powered By:

Today’s Summary

Friday, June 9, 2023

Indices: Nasdaq 100 +0.30% | Dow +0.13% | S&P 500 +0.12% | Russell 2000 -0.80%

Sectors: 5 of the 11 sectors closed higher. Consumer Discretionary led, gaining +0.52%. Materials lagged, falling -0.83%.

Commodities: Crude Oil futures fell -1.57% to $70.17 per barrel. Gold futures were flat and remained at $1,977 per oz.

Currencies: The US Dollar Index rose +0.23% to $103.55.

Crypto: Bitcoin was flat and remains around $26,500. Ethereum fell -0.47% to $1,838.

Interest Rates: The US 10-year Treasury yield rose to 3.743%.

Here are the best charts, articles, and ideas being shared on the web today!

Chart of the Day

For the first time since Nov 2021, we had a week full of quiet strength:

No days with a 1% swing in the S&P 500 AND no days with new lows exceeding new highs. pic.twitter.com/QS7C7Yr3L5

— Willie Delwiche, CMT, CFA (@WillieDelwiche) June 9, 2023

Today’s Chart of the Day was shared by Willie Delwiche (@WillieDelwiche). The S&P 500 continued higher for the fourth consecutive week, rising just +0.39%. It wasn’t much, but it was enough to mark yet another 52-week high (on a weekly closing basis). Willie points out that this was the first week since before the market topped where the S&P 500 had no daily swings greater than 1% and no days with new lows > new highs. This week’s “quiet strength” represents a shift toward bull market behavior, where the index grinds higher on low volatility, supported by broad strength beneath its surface.

Quote of the Day

“Support and resistance, like good wine, become better with age. “

– Dr. Alexander Elder

Top Links

The Bulls are Back in Town – LPL Financial Research

Adam Turnquist lays out everything you need to know about technical bull markets.

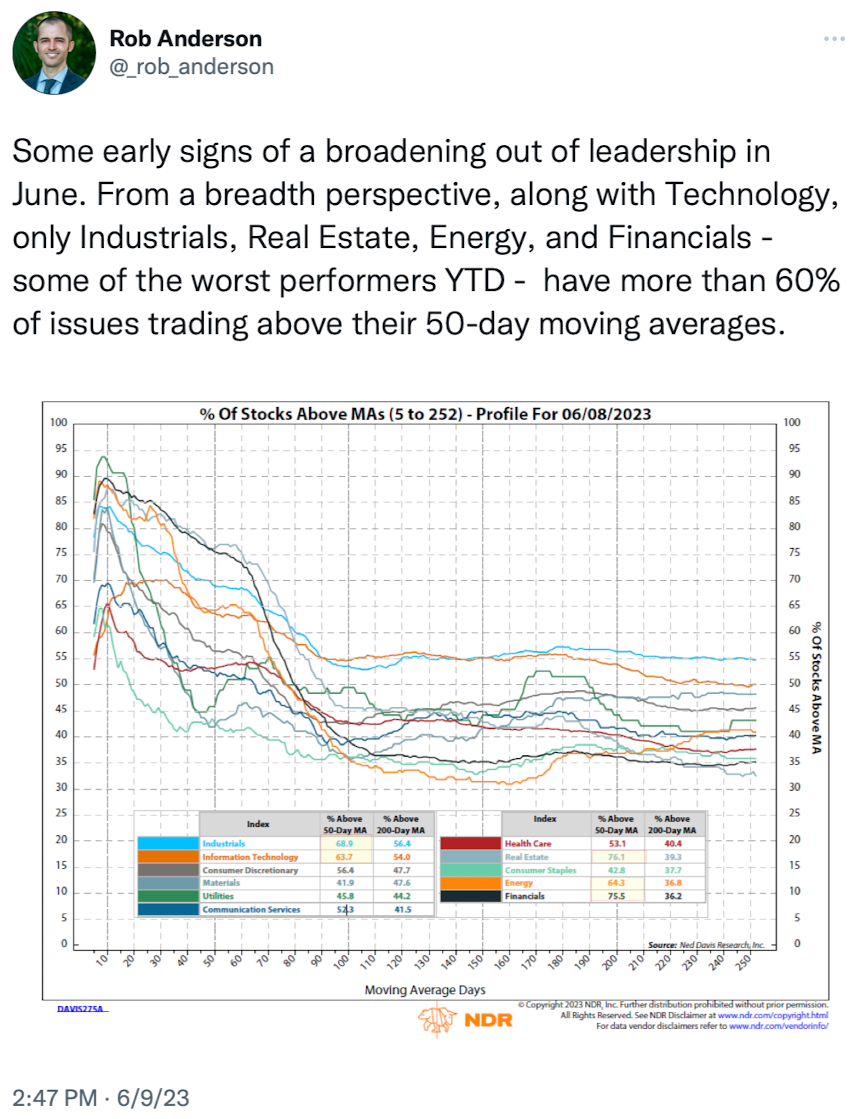

The Next Big Rotation – The Weekly Grind

Sam McCallum looks at the recent rotation and weather it will continue.

Tech Stocks Leading the Way – Grindstone Intelligence

Austin Harrison highlights several noteworthy charts in the Technology sector.

Indexes Level Off – StockCharts.com

Greg Schnell breaks down the charts of the major indices and a few important industry groups.

Gold Bugs Would Love to See Weakness Here, Says Joe Friday – Kimble Charting Solutions

Chris Kimble examines the relationship between the US Dollar and Gold.

The Chart Report is now better than ever…

Introducing The Chart Report: Private Access.

Private Access is everything you love about The Chart Report – plus MORE charts, trade ideas, and access to our exclusive scans and model portfolio updates.

Top Tweets

You’re all caught up now. Thanks for reading!