Daily Chart Report 📈 Monday, June 12, 2023

Powered By:

Today’s Summary

Monday, June 12, 2023

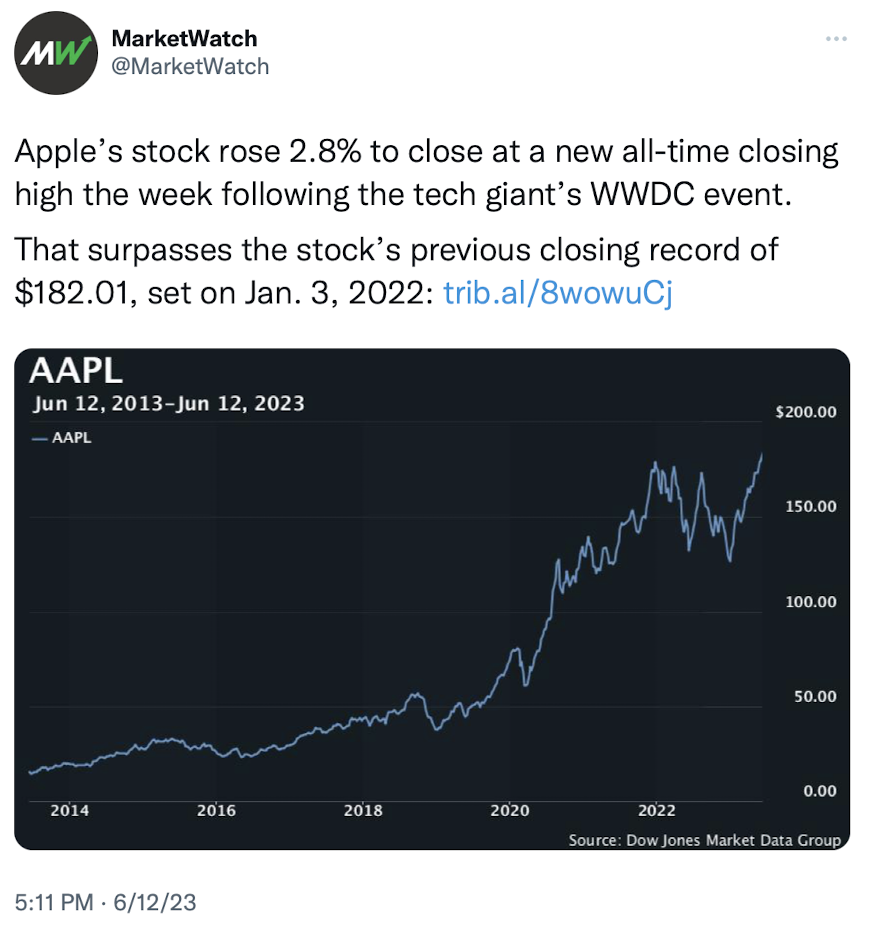

Indices: Nasdaq 100 +1.76% | S&P 500 +0.93% | Dow +0.56% | Russell 2000 +0.40%

Sectors: 6 of the 11 sectors closed higher. Tech led, gaining +2.17%. Energy lagged, falling -0.96%.

Commodities: Crude Oil futures dropped -4.35% to $67.12 per barrel. Gold futures fell -0.38% to $1,970 per oz.

Currencies: The US Dollar Index inched higher by +0.07% to $103.63.

Crypto: Bitcoin was flat and remains around $25,925. Ethereum fell -0.60% to $1,743.

Interest Rates: The US 10-year Treasury yield was flat and remains at 3.743%.

Here are the best charts, articles, and ideas being shared on the web today!

Chart of the Day

$SPX S&P 500 Index, closing the day at fresh 52-week highs and above the 0.618 Fibonacci retracement. pic.twitter.com/iGnM9yIs8d

— Shane C. Murphy (@murphycharts) June 12, 2023

Today’s Chart of the Day was shared by Shane Murphy (@MurphyCharts). The S&P 500 closed at a new 52-week high today for the first time since its peak more than 18-months ago. It cleared the August highs (around 4300) and closed above the 61.8% Fibonacci retracement of last year’s decline. Today also marks the first day in more than a year that the S&P 500 has been less than 10% below all-time highs. Bulls have plenty to celebrate today, but there are several potential catalysts on deck this week that could spur a reversal or volatility (CPI tomorrow, the Fed on Wednesday, and Quad Witching on Friday.) .

Quote of the Day

“When a trader starts to feel really smart he/she is headed for a huge drawdown.”

– Peter Brandt

Top Links

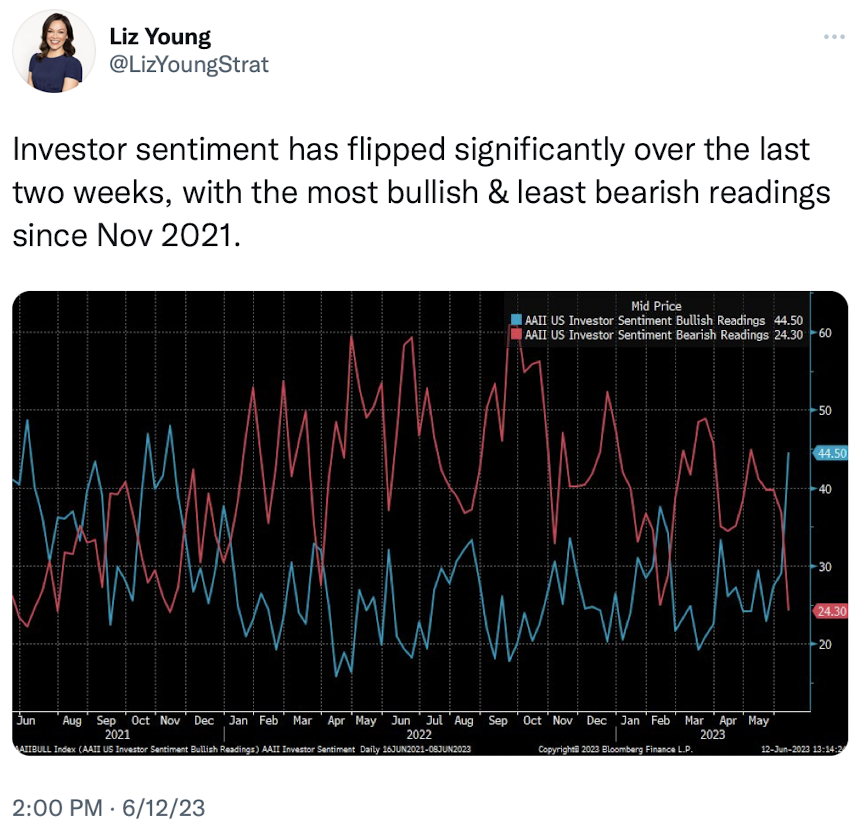

Market FOMO “Tidal Wave” Building – CNBC

Todd Sohn of Strategas Research offers his perspective on the current market environment.

Lucky Seven for the Nasdaq – Bespoke

Bespoke highlights the seven-week winning streak in the Nasdaq Composite.

Nasdaq 100 vs the Rest of the World – StockCharts.com

Arthur Hill looks at the Nasdaq’s outperformance over various time periods.

Time to Buy the Small Caps? – Grindstone Intelligence

Austin Harrison looks at what could be next for Small Caps after their recent bout of outperformance.

June’s Quad Witching Options Expiration Riddled With Volatility – Almanac Trader

Jeff Hirsch examines how the major averages have historically performed around June Quad Witching, which is this Friday.

The Chart Report is now better than ever…

Introducing The Chart Report: Private Access.

Private Access is everything you love about The Chart Report – plus MORE charts, trade ideas, and access to our exclusive scans and model portfolio updates.

Top Tweets

You’re all caught up now. Thanks for reading!