Daily Chart Report 📈 Friday, June 16, 2023

Powered By:

Today’s Summary

Friday, June 16, 2023

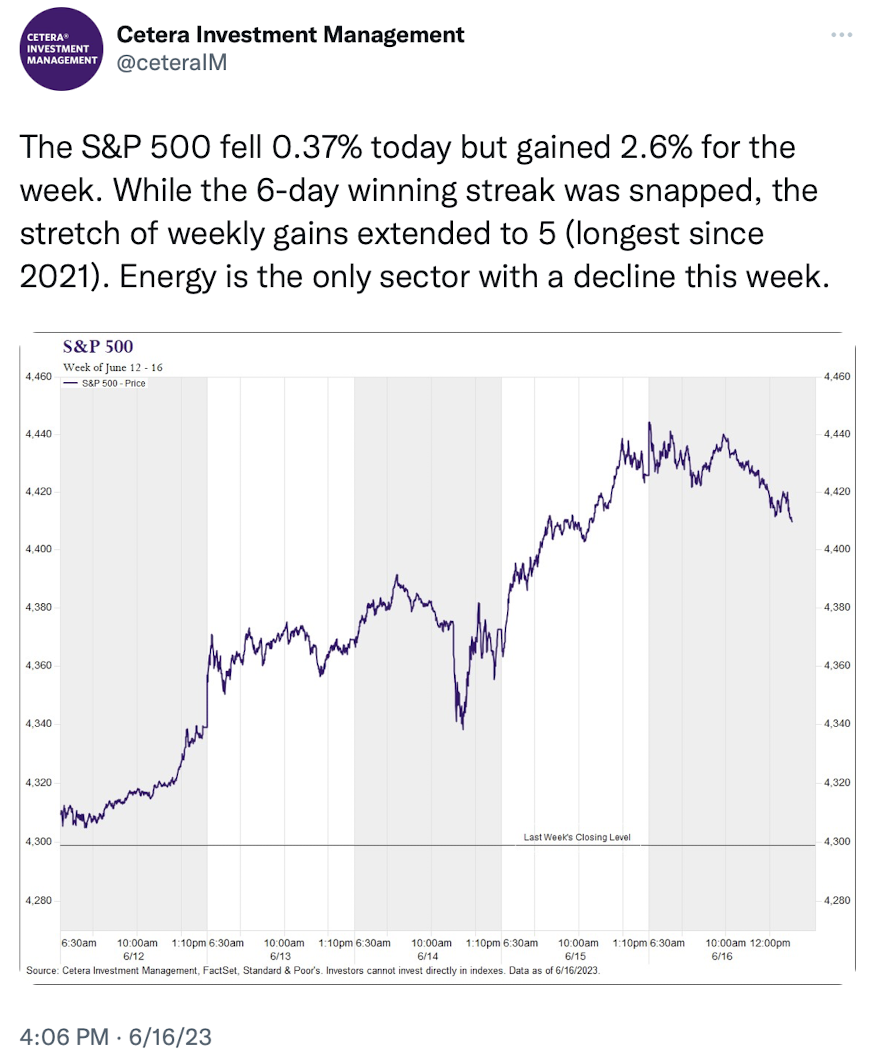

Indices: Dow -0.32% | S&P 500 -0.37% | Nasdaq -0.67% | Russell 2000 -0.73%

Sectors: 3 of the 11 sectors closed higher. Utilities led, gaining +0.54%. Communications lagged, falling -0.83%.

Commodities: Crude Oil futures rose +1.58% to $71.93 per barrel. Gold futures were unchanged and remain at $1,971 per oz.

Currencies: The US Dollar Index inched higher by +0.15% to $102.30.

Crypto: Bitcoin rose +2.97% to $26,333. Ethereum gained +3.11% to $1,717.

Interest Rates: The US 10-year Treasury yield rose to 3.769%.

Here are the best charts, articles, and ideas being shared on the web today!

Chart of the Day

Today’s Chart of the Day was shared by Jay Woods (@JayWoods3). It’s a weekly candlestick chart of the Industrial Sector ($XLI) over the past five years. The largest stocks within $XLI include, $RTX, $HON, $UPS, $CAT, and $UNP. Jay points out that the Industrial sector is approaching blue-sky territory after recovering from a 22.5% drawdown. It’s already at 52-week highs (on a weekly closing basis), and it’s about 1.5% from all-time highs. It’s built a two year base to launch higher from, with resistance around $107. A potential breakout would further confirm a new bull market given that Industrials have historically been one of the most positively correlated sectors to the S&P 500.

Quote of the Day

“Simple can be harder than complex: You have to work hard to get your thinking clean to make it simple. But it’s worth it in the end because once you get there, you can move mountains.”

– Steve Jobs

Top Links

Volatility Regime Shift – LPL Financial Research

Adam Turnquist explains why the S&P 500 could be shifting into a low volatility environment.

Four Things the Bulls Need to Know – Carson Group

Ryan Detrick highlights four reasons why the bulls should embrace this rally.

Is There Big Tech Trouble in FANG(sta’s) Paradise? – StockCharts.com

Julius de Kempenaer examines potential rotation within the technology sector.

June Sector Update: Industrials – Grindstone Intelligence

Austin Harrison looks at the industrial sector as it approaches record highs.

Silver Prices Testing 800 Pound “Pennant” Breakout Resistance! – Kimble Charting Solutions

Chris Kimble points out that Silver’s long-term chart is building potential energy for a strong move.

The Chart Report is now better than ever…

Introducing The Chart Report: Private Access.

Private Access is everything you love about The Chart Report – plus MORE charts, trade ideas, and access to our exclusive scans and model portfolio updates.

Top Tweets

You’re all caught up now. Thanks for reading!