The Footwear Party is Over

When consumer giants fail there's always other companies there to gather the lost marketshare. That's a core rule of trading these groups. Consumers drive ~70% of American GDP every year. Some years are better than others but the market for "Selling Stuff" is pretty well saturated on a macro basis.

The way to make money is to figure out who's gaining share and figuring out ways to trade around the bigger trend. For the last two years the best opportunity in fashion has been buying the companies that benefit from the slow, grim collapse of the Nike empire.

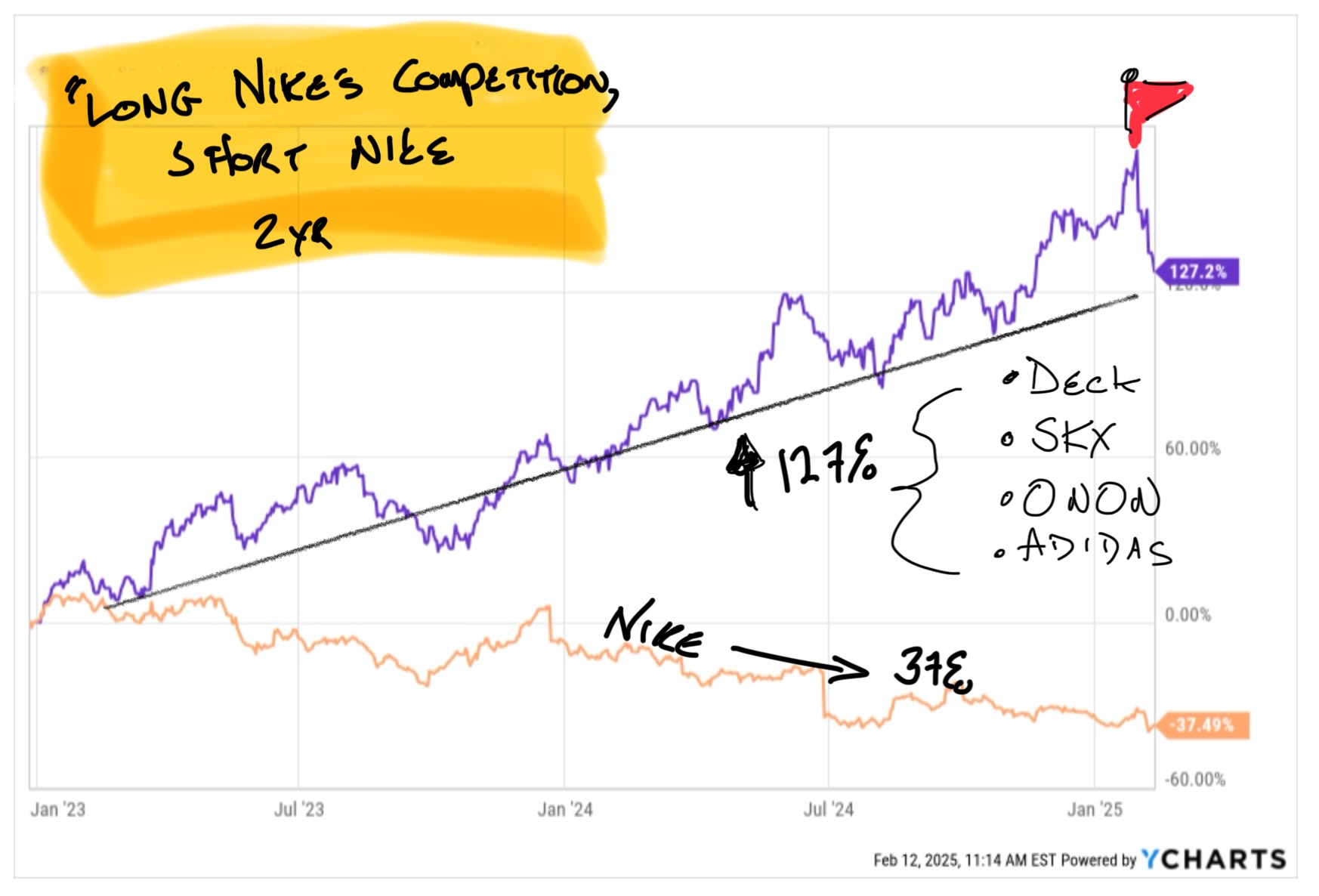

Here's a basket of On, Deckers, Adidas and Skechers long vs Nike since the start of 2023:

Shorting Nike was a pretty good trade but it's been choppy. No one ever wants to believe it when a giant like Nike starts rolling over. Only in retrospect is it obvious.

The consistent money has come from keeping it simple and just owning the handful of brands grabbing the marketshare Nike was losing. The trade worked because Nike was, and remains, enormous. The company isn't doing anything great at the moment but they do a lot of it; some $51b in annual revenues. That's a lot for a company selling shoes and sweatpants no on much cares for, even if the topline has been eroding for a few years.

But a company like Swiss upstart On doesn't need a lot of help. At a $2b revenue run rate just grabbing a corner of the market for ~$200 running shoes is more than enough. Deckers ($4.2b) On ($2b) and New Balance (private, ~$6b) together are only 1/3 the size of Nike in footwear. If Nike running declines, say, 3% that's over $10% potential growth for the others.

That's how it's been playing out and the trade worked great. But that was before tariffs and questions about saturation and some currency headwinds. And it was really before Deckers pulled a "Beat and Disappoint" quarterly report in late January.

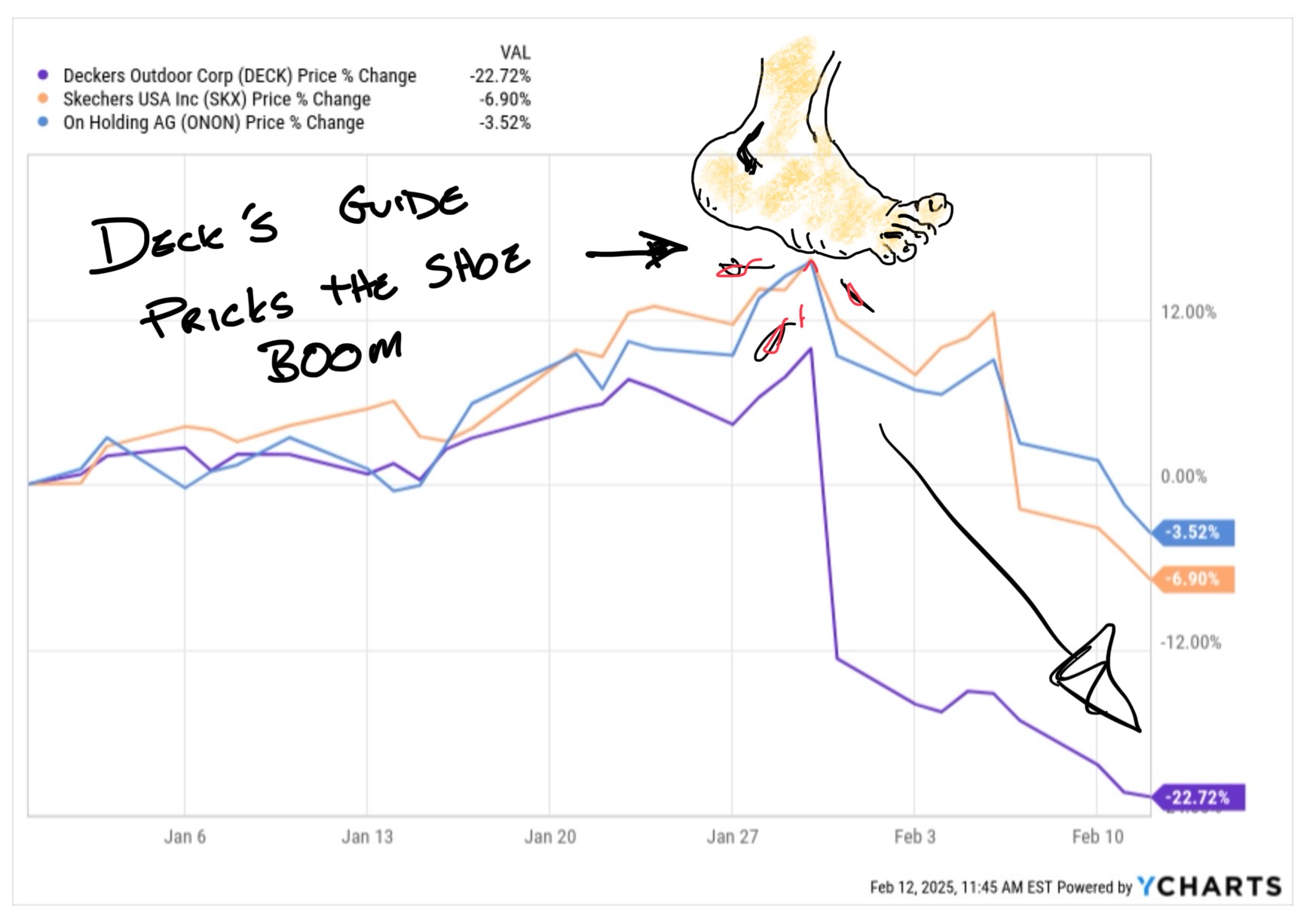

Decker's its HOKA have been the poster shoes of the anti-Nike revolt. So when Deckers told analysts margins were going lower this year and used disturbing terms "promotional activity" analysts lost their collective squash and the damage hasn't really been contained to Deckers, especially once Skechers came out with its own atypically bad results.

The news reversed the whole shoe move. Deckers is now down 30%, falling on 8 of the 9 trading days since reporting. On, which was just minding its own business in Switzerland since saying rather bullish things in early January is 17% off the ATH levels it was parked at when Deckers dumped.

What to Watch Now

I'm long ONON and generally happy about it but I'm not made of stone. The selling sucks and On doesn't report until March, which seems like a million years from now. If, as I suspect, On is showing much better pricing power than Deck's HOKA and IF, bigger IF, apparel is getting traction then ONON will rally just fine. The bet here is On is becoming a huge margin, mainstream brand. Lululemon is the gold standard for that type of growth but even there it took a while before the stock really exploded. There's no sense being a hero.

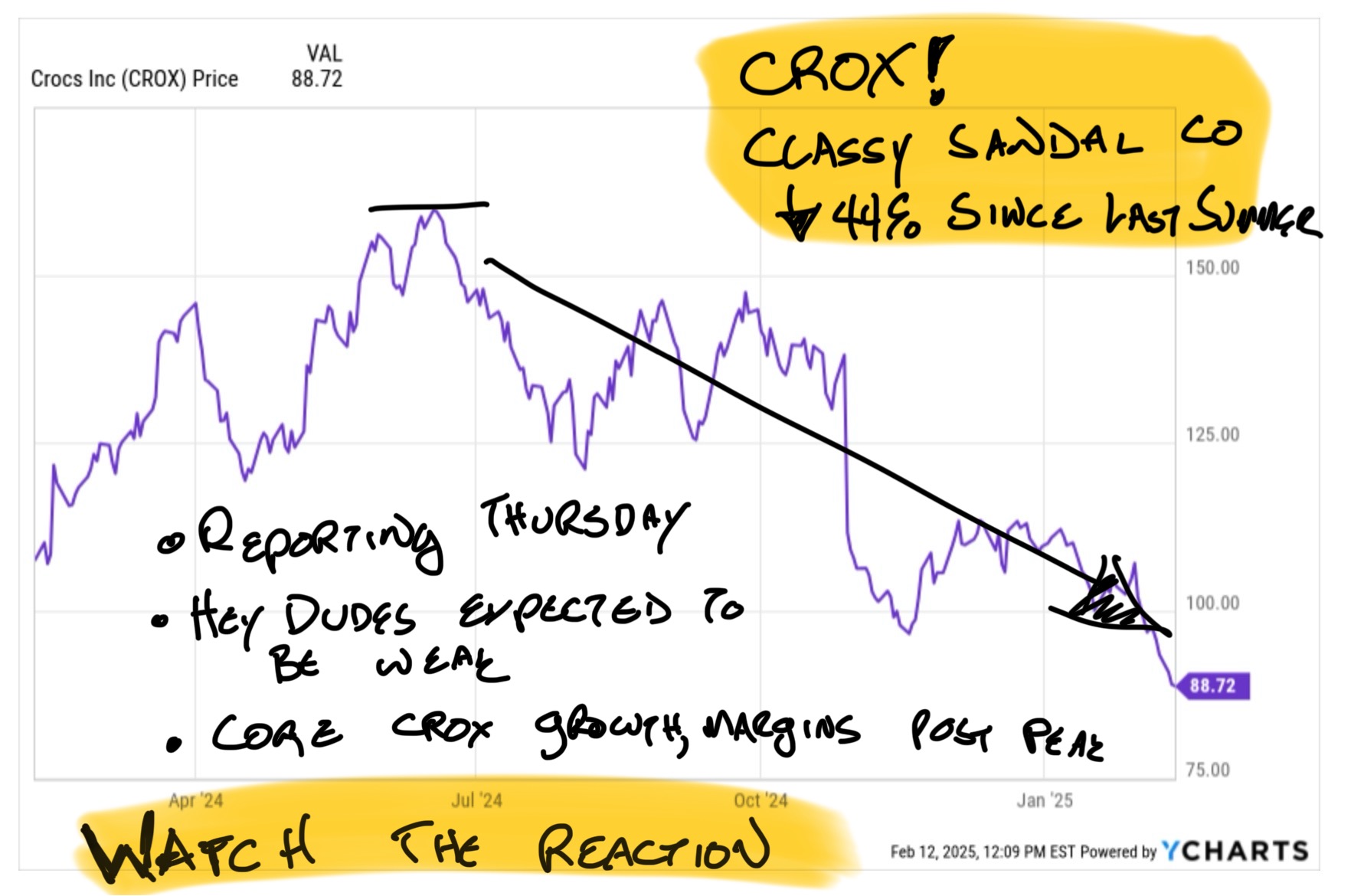

The better tell right now for "how much bad news is in these stocks" comes Thursday from, believe it or not, Crocs. The maker of timeless, classic plastic sandals is down 44% from the highs of last summer and seemingly every day for about the last month, after cancelling an appearance at a popular conference for the first time in ages.

Crocs is going to report "fine" results for the main brand and something terrible for its lagging boat shoe division. Everyone knows this. The always-insightful Everyone also knows there are going to be FX headwinds and most likely a soft guide for this year.

The question isn't if CROX will be good but rather what price, if any, is anyone willing to get long generally reviled but stable business. Crocs is trading for 6.4x trailing and 7x forward earnings. So earnings are going lower but Crocs is still a >25% EBITDA margin company. It's at 5.5x EV to EBITDA, a valuation typically reserved for much worse companies.

If CROX can't bottom tomorrow or soon after it drops the other shoe on a lousy outlook strap up for more pain in the shoe space. After running 127% in two years the whole group is looking a little gassed.